I’ve always been a thrifty girl, not drawn in by flashy, name brand things. I get pretty excited when I find a great deal on something that I need. After becoming a homeowner and then a mother, I found new ways to save on necessary purchases. If you haven’t fully embraced technology and all the ways it can help you save money, I’ve got a helpful guide below to get you started!

1. Coupons

This is obviously nothing new, but the days of clipping coupons from the Sunday paper have definitely evolved. With websites like Coupons.com and Groupon, you get much more variety. If you eat very healthy, organic food and are convinced coupons do not exist for these things, think again! Mambo Sprouts and Common Kindness are two of my favorite websites for organic coupons. You can also visit the websites and Facebook pages for your favorite brands to find discounts and coupons.

2. In-Store Apps

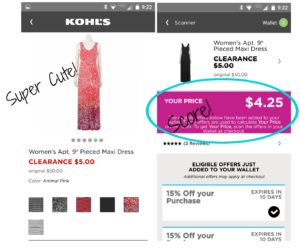

Most department and and grocery stores now have their own apps you can download and use in the store. My favorite department store apps are  Kohl’s and Target. Both of these allow you to scan merchandise and see eligible discounts. The Target app now has Cartwheel built in, which allows you to add manufacturer’s coupons and store discounts you find in Cartwheel to your Target wallet in the app. In the wallet, you can sometimes find additional coupons such as $5 off a $25 beauty supply purchase. When you get to the register, just pull up the wallet in the app and the cashier will scan the barcode, automatically taking off the Cartwheel coupons and discounts. The Kohl’s app will show you if the item is on clearance as well as your discounted price if you’re enrolled in their Rewards program, and discount offers the item is eligible for. If you shop at Kohl’s, do yourself a favor and get this app! One time I paid under $5 for a very cute dress that originally was priced at $50! Be sure and download your favorite grocery store’s app also. For most stores, you can link your club card to the app and add discounts and coupons while you’re shopping.

Kohl’s and Target. Both of these allow you to scan merchandise and see eligible discounts. The Target app now has Cartwheel built in, which allows you to add manufacturer’s coupons and store discounts you find in Cartwheel to your Target wallet in the app. In the wallet, you can sometimes find additional coupons such as $5 off a $25 beauty supply purchase. When you get to the register, just pull up the wallet in the app and the cashier will scan the barcode, automatically taking off the Cartwheel coupons and discounts. The Kohl’s app will show you if the item is on clearance as well as your discounted price if you’re enrolled in their Rewards program, and discount offers the item is eligible for. If you shop at Kohl’s, do yourself a favor and get this app! One time I paid under $5 for a very cute dress that originally was priced at $50! Be sure and download your favorite grocery store’s app also. For most stores, you can link your club card to the app and add discounts and coupons while you’re shopping.

3. Rebate Apps

Most popular with grocery store purchases, these rebate apps allow you to submit your receipts and receive cash back for eligible purchases. My favorite apps are Ibotta and Checkout 51. These started a little shaky, but are now very easy to use. You can usually find at least a couple items each shopping trip since offers sometimes include any brand products like any brand of cereal or produce that is in season and an Any Item offer. It only takes a few minutes to browse through the offers, scan a few barcodes, and upload your receipt. In Ibotta, you can withdraw funds in the form of gift cards or through PayPal or Venmo. Checkout 51 will send you a check and will soon have the option to transfer funds to PayPal.

4. Facebook Buy/Sell/Trade Groups.

This is where I get most of my kids’ clothing, shoes, and baby/toddler gear. Since babies grow so fast, it makes sense to buy things used. I’ve found some great deals on baby clothes, shoes, strollers, high chairs, and other baby items that I’ll only use for a year or two. Things like baby slings and carriers are nice to find used since you don’t always know if a particular brand will work out for you. And if it doesn’t work out for you, go ahead and re-sell it! I’ve also found furniture on these groups. Until I’m confident my kid will not draw or spill on my couch, I refuse to buy something brand new. You may even be able to find a “Buy Nothing” group in which people in your neighborhood are giving away things for free.

5. Buy In Season and On Sale.

When planning your meals and grocery shopping, always check out the store ads first. Check out the store’s app or download the Flipp app to find most retailers’ weekly ads and match them to digital coupons. You can usually tell what’s in season because it’s featured and heavily discounted. In late summer sometimes you’ll see 10 ears of corn for $1. I like to plan my meals around things that are in season to get the most out of my shopping trip. You’ll also find that seafood and meat are discounted depending on the season and occasion. For example, on Memorial Day weekend you’ll find hot dogs, BBQ meats, ketchup, etc. on sale.

Don’t forget – you’re not really saving money if you buy something that isn’t a necessary purchase or that you weren’t already planning on buying.